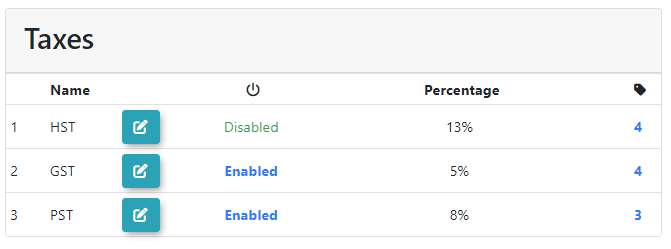

Taxes

ThisThe Taxes configuration page in OPSCOM allows administrators withto appropriate rolesdefine and permissions to configuremanage the tax percentagepercentages calculatedapplied to payments made within the system. This feature is crucial for ensuring accurate tax calculation during checkout, maintaining compliance with local tax regulations, and chargedproviding transparency to users whenregarding makingapplicable payments in OPS-COM.taxes.

Setup & Configuration

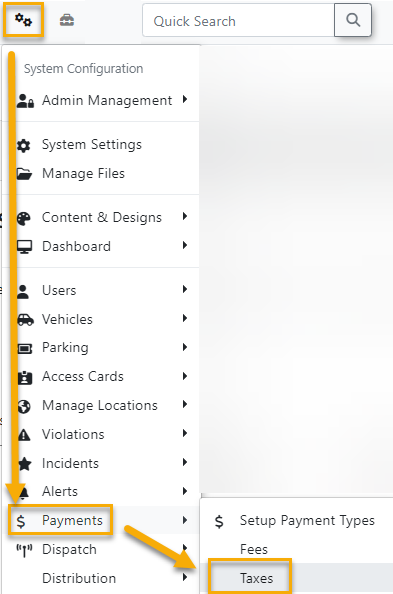

You canmust findbe a Primary Admin with the taxespermission pageto under theManage System Configuration →to Paymentsbe →able Taxes.

If you do not see the settings mentioned above,in this article, please contact support@ops-com.comcom to have them enabled for you. You will needneed, in writing, the permission of your Primary Admin.

Using this Feature

The Taxes page allows you to configure multiple settings for each tax type, ensuring accurate calculation and display.

1. Hover over System Configuration, Payments, and click Taxes.

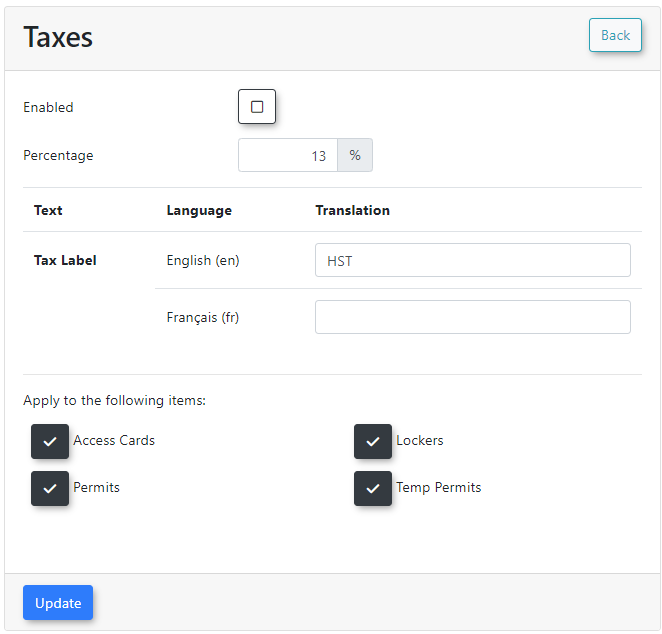

Editing a Tax Type

When editing aan existing tax type, therethe following settings are multiple settings:

Enable: Check

to transactions. Uncheck to disable it.orthisuncheckboxwhethertoorenablenot thisthe taxtypetype,ismakingenabledit(checked)activeoranddisabledapplied(unchecked).Percentage:

(e.g.,TheEnter the numerical percentage oftaxestax to be calculated13for 13%).Tax Label & Translation:

are supported for translation to ensure clarity for diverse users.HowThis field defines how this tax will be displayed to usersinduring thecart/cart and checkoutprocess.process (e.g., "HST," "Sales Tax," "VAT"). Multiple languagessupported.Apply to the following items: Check the specific system modules or item types to which you want this tax to be applied

(e.g., Permits, Violations, Lockers).to.

Best Practices & Considerations

- Compliance: Ensure your tax configurations (percentages, labels, and applicability) are always compliant with current local, provincial/state, and national tax regulations.

- Clarity for Users: Use clear and understandable Tax Labels that resonate with your users (e.g., "HST" for Canadian users where applicable).

- Module Applicability: Carefully select the "Apply to the following items" checkboxes to ensure taxes are only applied to the correct modules and items, preventing incorrect charges.

- Testing: After making any changes to tax settings, perform test transactions in a Preview Space to verify that taxes are calculated and displayed correctly in the cart and on receipts.

- Communication with Finance: Coordinate closely with your organization's finance or accounting department to ensure OPSCOM's tax configuration aligns with their reconciliation processes.