Payroll Deduction Report

The

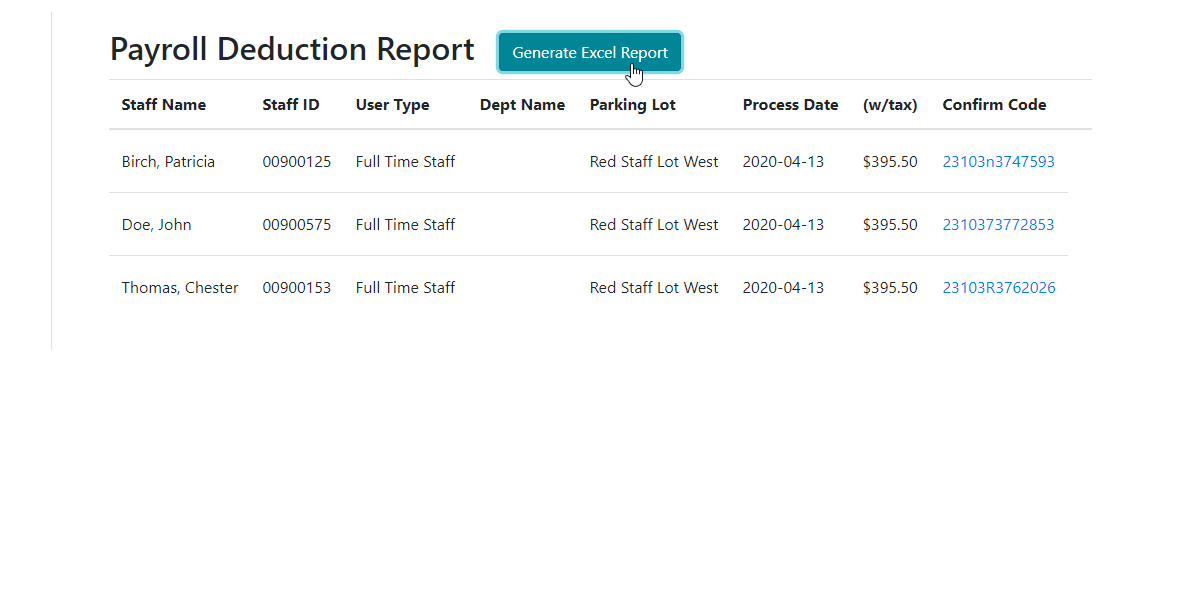

This article explains how to use the Processed Payroll Deduction ReportReport. This report provides OPSCOM administrators with a comprehensive list of all permit payments processed using the payroll deduction method. Its primary purpose is to generate a file that can be submitted to an organization's finance or payroll department.

Setup & Configuration

ToNo specific configuration is required to access this report. However, the report:Payroll Deduction payment option must be enabled and configured within your system for transactions to appear in this list.

For more information on enabling payment options, please refer to the Payment Methods Configuration wiki article.

Using this Report

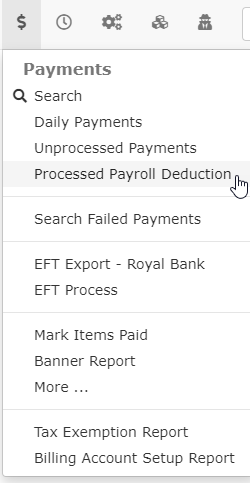

Go to the Payments Menumenu. and selectclick Processed Payroll Deduction.

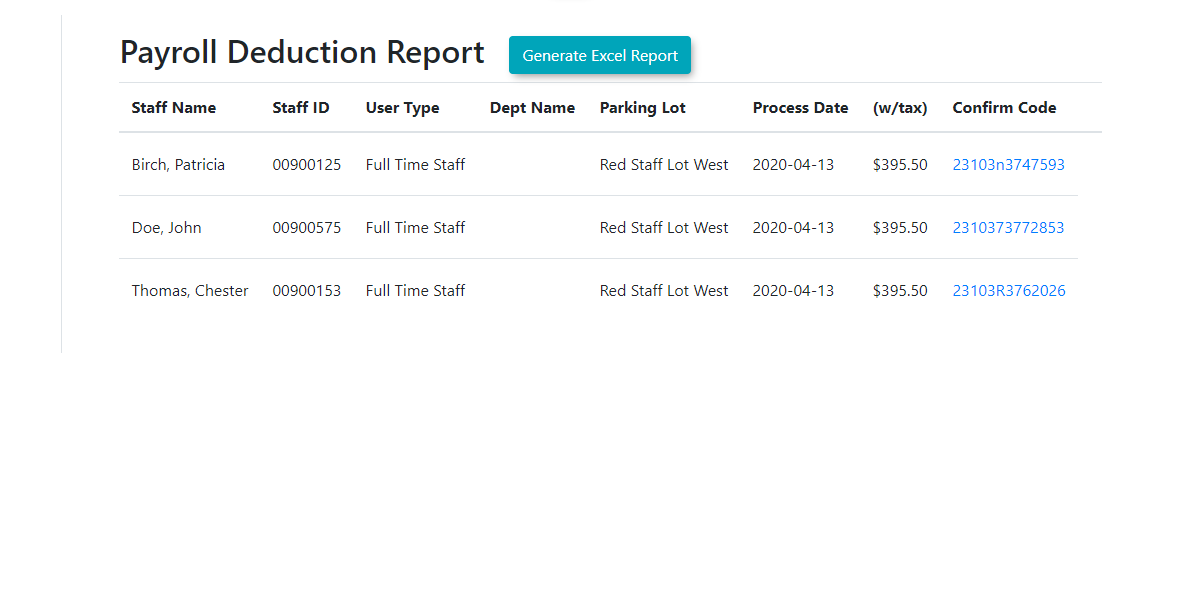

The screenpage will refresh withand display a listinglist of all processed Payrollpayroll Deductions.

deduction transactions.

Key Information Displayed

TheViewingreport table includes the following key details for each transaction:

-

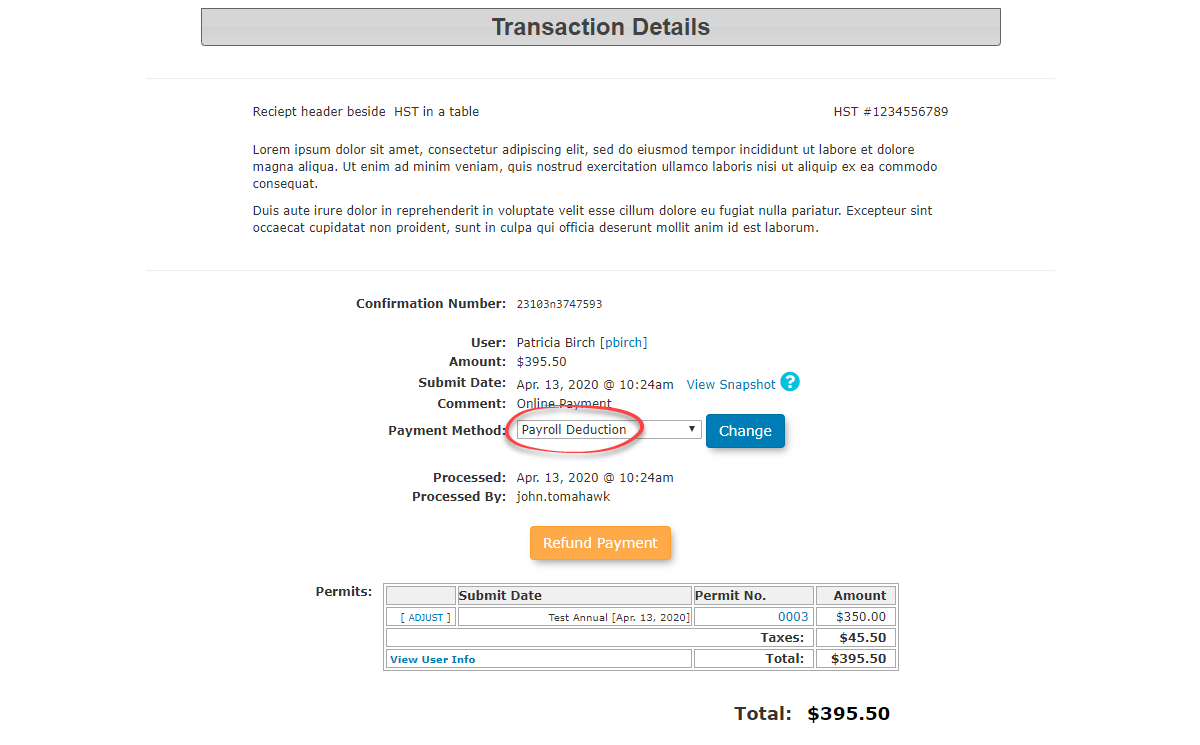

Transaction Details

Number: The unique identifier for the payment.

Transaction Details

FromUser Information: The name and identifier of the user who made the purchase.

Permit Details: Information about the associated parking permit.

Transaction Amount: The total cost of the permit to be deducted.

Date Processed: The date the transaction was recorded in OPSCOM.

Flex Dollars

If your organization has flex dollars enabled, a separate column for this screenwill yoube can selectadded to lookthe atreport. It displays the actualportion transactionof recordthe transaction, if youany, wish.that was paid for using a user's flex dollar balance. See this article to learn more about flex dollars and whether or not it may be useful for you.

Available Actions

-

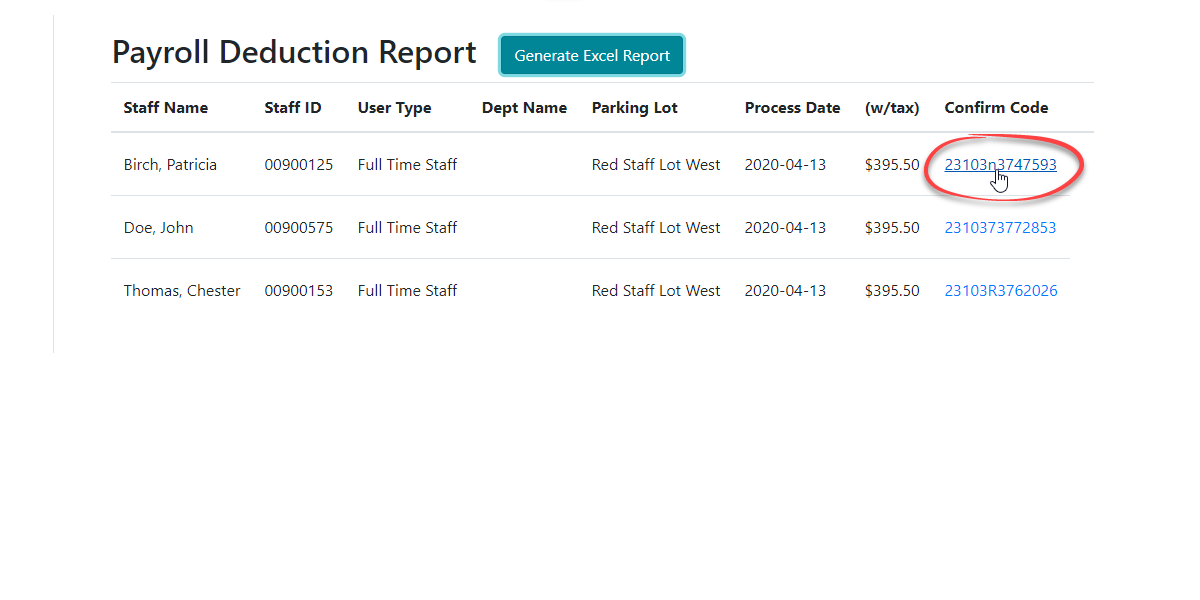

Transaction Number: Click

onathespecific transaction numberto access the detailed information.This will bring you to theTransaction DetailsScreen.Export to ExcelTypically the admin would exportin the list toexcelnavigateto supplydirectly to thefinancialfulldepartmentTransactiontoDetailscollectscreentheseforpermitthatfeespaymentthroughrecord.the -

PayrollGenerate

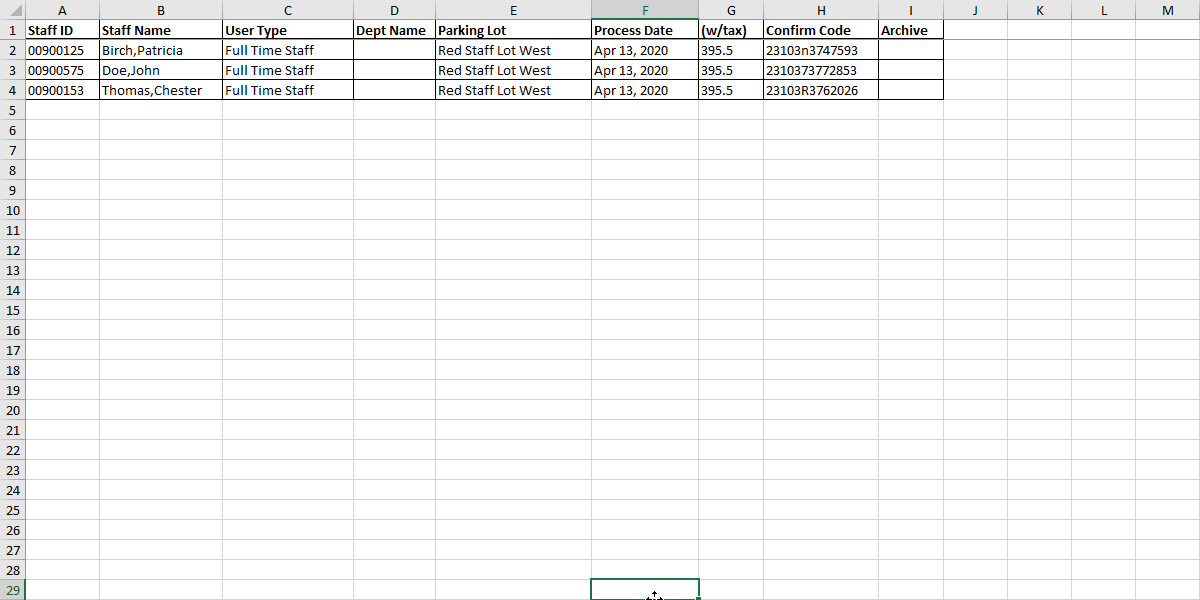

Deduction.SimplyExcelclickReport:onClick the Generate Excel Report buttontolocateddownloadat thereporttopasof the report. This action downloads the complete list of processed deductions in an Excelfile(.xlsx)format.file, formatted for easy submission to a payroll department.

InWarning: ExcelIt is crucial to establish a clear and consistent schedule for generating and submitting this report to your organization's finance or payroll department. Aligning on a submission deadline (e.g., two days before the reportpayroll willcutoff) lookensures likethat all deductions are processed in the following:

correct pay cycle and helps avoid payment discrepancies.

Best Practices & Considerations

-

Transaction Amountcolumn represents the final value to be deducted after the flex dollar payment has been applied. Ensure your payroll department understands this distinction to avoid incorrect deductions. -

Establish a Communication Protocol: Designate a clear point of contact within your team for the finance or payroll department to reach out to if they have questions or find discrepancies in the report. This ensures issues are resolved efficiently.