Using Tax Exemption

Adding a Tax ExemptExemption IDCodes

Searchare forsupported in the OPS-COM system. If a user and edit their profile. The Tax Exemption field is located on the User Profile screen and can contain alpha-numeric characters. New user profiles will also have this field.

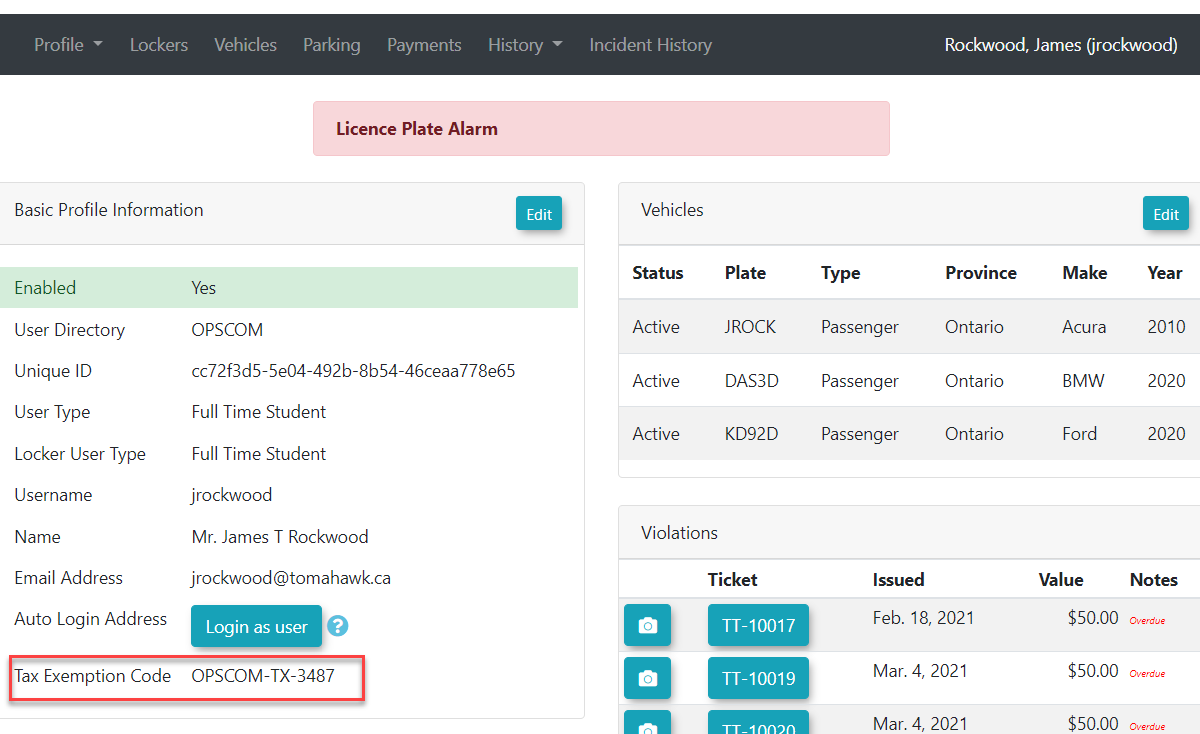

Note, Tax Exemption Code is included for viewing on the Basic Profile Info window for the User Profile.

When purchasing a permit with a user that has a tax exemption code on their profile, taxes will not be showncharged when they purchase items such as permits, violations and lockers.

Quick Steps:

-

Search for and select the User Profile.

-

Under Profile>Edit Profile Information, add or update the Tax Exemption Code field on the Edit User Profile screen.

- Click Submit Profile Information and then Confirm Information Correct buttons.

-

Verify the code is correct in the Profile Overview window.

-

Ensure tax-exempt transactions do not display taxes on the payment page.

-

Run and export the Tax Exemption Report from the Payments menu as needed.

Step by Step Instructions:

-

Search for the User:

-

Use the Quick Search or User Search functions to locate the user profile you want to edit.

-

-

Edit the Profile:

-

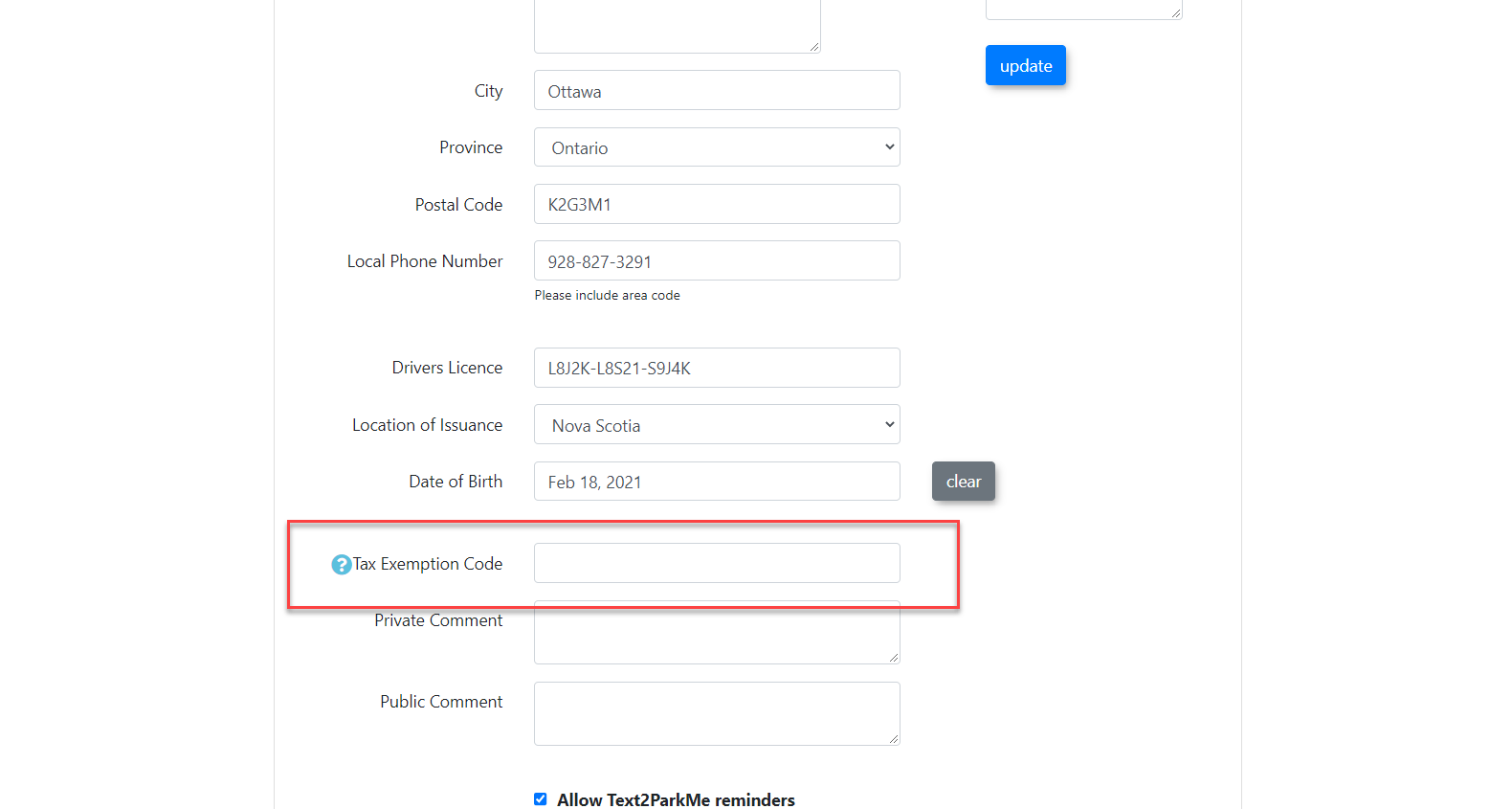

Open the User Profile and under Edit Profile Information locate the Tax Exemption Code field.

-

This field supports alphanumeric characters and is present on both new and existing profiles.

-

-

View Tax Exemption Code:

-

The Tax Exemption Code is displayed in the **Profile Overview **window for easy reference.

-

-

Tax-Free Transactions:

-

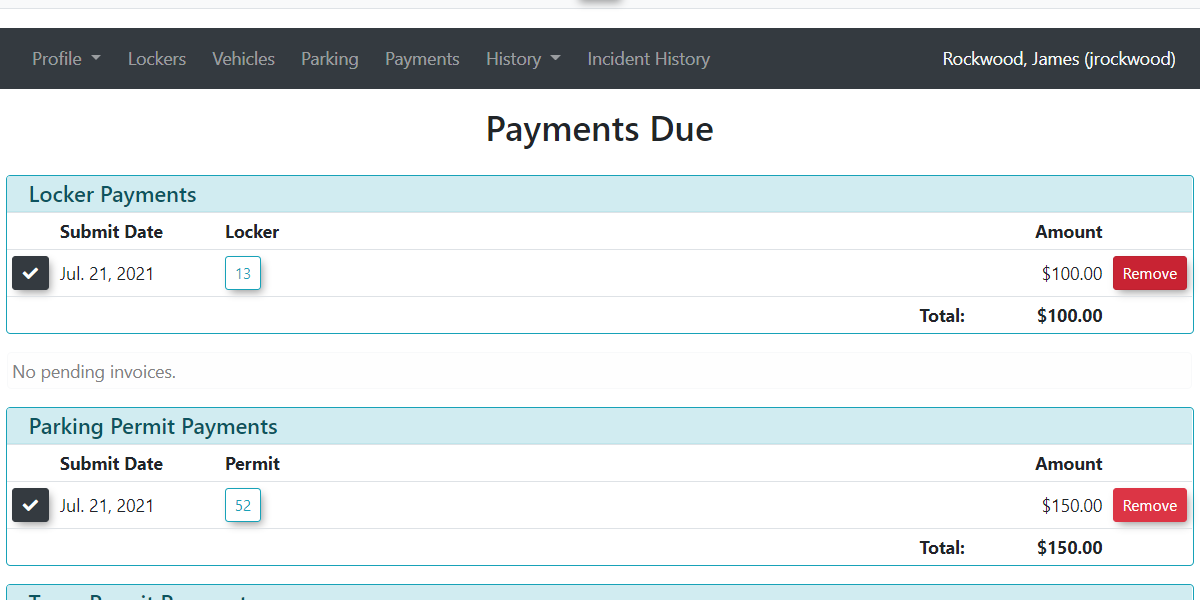

When purchasing a permit for a user with a tax exemption code, taxes will not appear as a line item

ofon the payment or confirmation page.

-

-

-

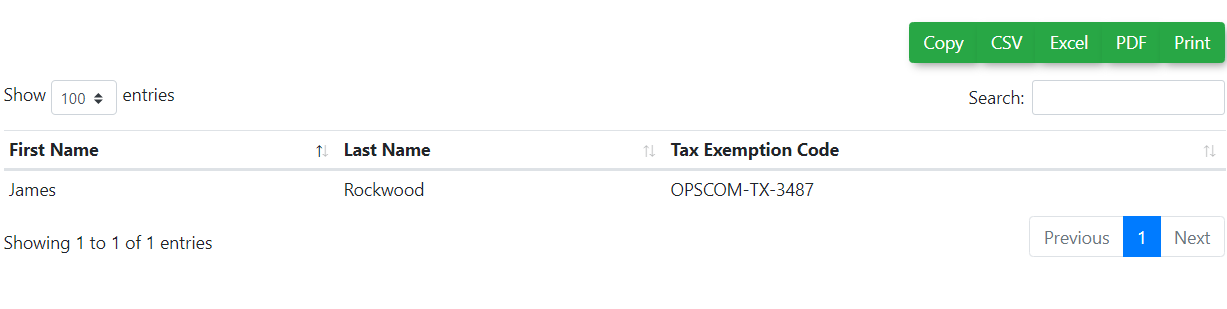

There is a tax exemption report that can be run underGenerate thePaymentsTaxmenu.ExemptionYou can choose to copy or export the recordsReport from the Payments menu. -

This report

whichincludescontainsthree3 fields,fields: First Name, Last Name, and Tax Exemption Code.

-